about us

We're CFML

CFML works to bring benefit to everyday New Zealanders. We have provided borrowers the opportunity to achieve their residential property goals, and in turn we have established a trusted investment product to seek to grow the wealth of New Zealanders.

Conrad Funds Management Limited (CFML) is a New Zealand-based boutique Fund Manager and was licensed in 2016. The vision of the business is to provide investors with investment products tailored to their needs, and with access to experienced professionals who endeavour to provide a product with a property focus.

CFML Loans is the lending arm of Conrad Funds Management’s business. CFML Loans (which includes CFML Lending Limited and Conrad Funds Management Limited) is a Non-Bank Lender that specialises in Residential 1st Mortgage lending. CFML Loans works with mortgage advisors throughout New Zealand to ensure customers get a quick response from our highly experienced lending team with over 30 years’ experience. Our strong focus is on delivering a solution to customers’ lending needs, while also delivering a positive customer experience.

New Zealand Immigration Criteria

Some New Zealand Managed Funds meet Immigration New Zealand’s Criteria for the Investor Plus Visa (Investor 1 Category) and the Investor Visa (Investor 2 Category) Residency Visas.

CFML’s Direct Invest and CFML Mortgage Fund meets the criteria for a “Growth Investment” for Immigration New Zealand purposes*

Conrad Funds Management Limited, is licensed under the Financial Markets Conduct Act 2013 to manage:

-

Other managed Investment Schemes which invest in real property and which may invest in bank deposit instruments; or

-

Managed investment schemes which invest in shares in companies which themselves invest in loans secured by property backed mortgages and/or Bank Deposit instruments; or

-

Property Syndicates/Real Property Proportionate Ownership Schemes which may invest in bank deposit instruments

Financial Services Provider Number: FSP441126

New Zealand Companies Register: 5691248

Financial Services Complaints Ltd: CFML F.S.C.L.6400

* Subject to Immigration advice. CFML makes no representations regarding individual investor immigration qualification.

Source:

CFML Independent Board of Directors

The CFML Board governs the Manager of the Funds financial stability, governing by adherence to set policies and objectives to ensure a high level of corporate governance aimed at protecting investors’ funds.

Frank Chan – Non-Executive Director / Chairman

Key Responsibilities: Chair of CFML and chair of Investment & Product Committee (IPC)

Frank is a commercial lawyer with over 25 years of experience specialising in financial markets law, including listed issuer regulation, corporate governance, securities law, capital and financial markets, financial services, and mergers and acquisitions for New Zealand and offshore investors. He was a Partner and Board member at Hesketh Henry and previously worked at Chapman Tripp and the Securities Commission (now the FMA). He now has his own private practice FC Law Partners. Frank is a past Convenor of the Auckland District Law Society Commercial Law Committee. He is contributing author for Morrison’s Company & Security Law and the author of the Financial Advisors Handbook (LexisNexis). Frank has a Bachelor of Laws and Bachelor of Commerce and Administration from Victoria University, New Zealand. He resides in Auckland, New Zealand.

Susan Hansen – Non-Executive Director

Key Responsibilities: Chair of Audit, Risk & Compliance Committee (ARCC)

Susan Hansen is a Chartered Accountant and has over 30 years of experience in the financial sector. She has held a number of Board positions both in New Zealand and overseas. She is currently a Non-Executive Director of a company listed on the London Stock Exchange. She is also the principal of a financial training organisation. Susan has an MBA in Finance from University of Cape Town, South Africa. She resides in Auckland, New Zealand.

CFML Executive Team

Our Executive Management team is a group of committed and experienced professionals. The CFML Executive Team strives to ensure a high level of corporate governance through a company structure which promotes transparency and an astute investment approach.

Patrick Middleton – Chief Executive Officer

Patrick has over 30 years of experience in the Funds Management industry. Over his time in Financial Services he has held a number of executive management positions including CEO at Perpetual, Spicers Portfolio Management Ltd (NZ) and Head of Wealth Management at Westpac Bank (NZ). He has a wealth of knowledge in New Zealand Funds Management businesses covering investment management, wealth management and portfolio management. His most recent role was consulting into the rural and financial services sectors in New Zealand. Patrick attained an MBA at Henley Management College, Henley, UK. Patrick resides in Auckland, New Zealand.

Email: patrickm@cfml.nz Phone: +64 9 320 0958 Mob: +64 29 770 0017

Johny Kale – Chief Operating Officer

Johny comes to CFML with over 20 years of experience in the Funds Management industry working across many jurisdictions; UK, Cayman Islands and Ireland, to name a few. Over this time he has held senior management roles at Northern Trust and most recently at North Asset Management LLP as the Operations & Treasury Manager, a position he held for 6 years. He has a wealth of knowledge in the Funds Management business covering Operations, Treasury, Hedge Fund, Legal and Compliance functions. Johny also attained a Bachelor of Business Studies (Finance & Property) at Massey University, New Zealand. He has also attained a Certificate in Investment Management, at Chartered Institute for Securities and Investment (UK), and also was an Approved Person (FCA) for North Asset Management LLP during his time in the UK. Johny resides in Auckland, New Zealand.

Email: JohnyK@cfml.nz Phone: +64 9 320 0957 Mob: +64 21 179 6410

CFML Team

Credit

Brent Malcolm – Mortgage and Credit Manager

Brent has over 30 years of experience in the banking and finance sector with a particular focus on lending to a broad range of clients within the New Zealand market. Past experience includes various roles at The National Bank of New Zealand Limited, HSBC New Zealand and with two finance companies. Recent roles included senior credit management responsibilities. Key responsibilities include; Mortgage Management, Credit assessment and being a member of the Credit Committee. Brent resides in Auckland, New Zealand.

Email: BrentM@cfml.nz Mob: +64 21 550 684

Jaewyn Mockford – Credit Review and Recoveries Manager

Jaewyn has over 30 years experience in the banking industry with a primary focus on Credit Lending in New Zealand. Past experience was at Bank of New Zealand and most recently ICBC New Zealand as their retail Credit Manager. She also held the Mortgage & Credit Manager role for CFML from March 2018 until December 2022 holding lending delegation. Key responsibilities includes; Mortgage Management, Credit Review and Recoveries, and Credit Committee member. Jaewyn resides in Auckland, New Zealand.

Email: jaewynm@cfml.nz Phone: +64 9 320 0959 Mob: +64 21 408 783

Operations & Treasury

Luke Wisbey – Financial Analyst

Luke graduated with a Bachelor of Commerce degree in Finance and Economics from the University of Otago. Luke has also completed courses from Yale University and Hong Kong university of science and technology in Financial Markets and Python and Statistics for Financial Analysis. Luke resides in Auckland, New Zealand.

Email: LukeW@cfml.nz Phone: +64 9 320 0956 Mob: +64 27 411 3065

Campbell Mabin – Financial Analyst

Campbell is a recent graduate from University of Canterbury with a Bachelor of Commerce majoring in Finance and Economics. Campbell is a Chartered Alternative Investment Analyst (CAIA®) Charter holder. Campbell resides in Auckland, New Zealand.

Email: CampbellM@cfml.nz Phone: +64 9 972 3867 Mob: +64 21 758 026

Compliance

Elizabeth Ginever – Risk and Compliance Manager

Key Responsibilities: Compliance Reporting Manager, AML Officer, Risk Management Officer, Compliance Training Manager, Audit, Risk & Compliance Committee member.

Elizabeth has over 20 years of experience in the Risk & Compliance sector in Australia, UK and New Zealand. She has held various senior compliance roles before starting her own Compliance & Risk consulting company which she has been running for the last 12 years. She holds a Diploma in Financial Markets and has been an Associate member of the Financial Services Institute of Australasia. Elizabeth resides in Auckland, New Zealand.

Email: Elizabethg@cfml.nz Phone: +64 21 398 138

Loan Originators

Yuan Fang – Head of Client Relations

Yuan joins the Conrad Funds Management team with a depth of Banking & Investment experience in New Zealand having worked at ASB for the last over 12 years. . She has been a leader at ASB in Business Relations Management in both the Retail & Commercial banking divisions. She has a real focus on supporting clients through their financial goals. She was educated in New Zealand and obtained her Bachelor of Business Studies from Massey University in 2003. Yuan is also fluent in Mandarin. Yuan resides in Auckland, New Zealand

Email: yuanf@cfml.nz Phone: +64 9 222 2903 Mob: +64 21 187 9160

Andrew Stevenson – Relationship Manager

Over the last 15 years, Andrew has gained solid experience in retail, commercial, wholesale and property finance. He holds a Bachelor of Commerce from the University of Auckland, and recently returned to Auckland after 6 years in the Bay of Plenty.

Mobile: 021 194 8163 Email: andrews@cfml.nz

Daniel Gay – Relationship Manager

Daniel is originally from Christchurch and has over 10 years experience in bank, non-bank, prime and non-prime lending both in New Zealand and Australia. Working in the space between advisors and lenders with a wide range of funding lines, he enjoys the challenge of finding a home for all manner of scenarios.

Mobile: 027 386 3464 Email: danielg@cfml.nz

Governance

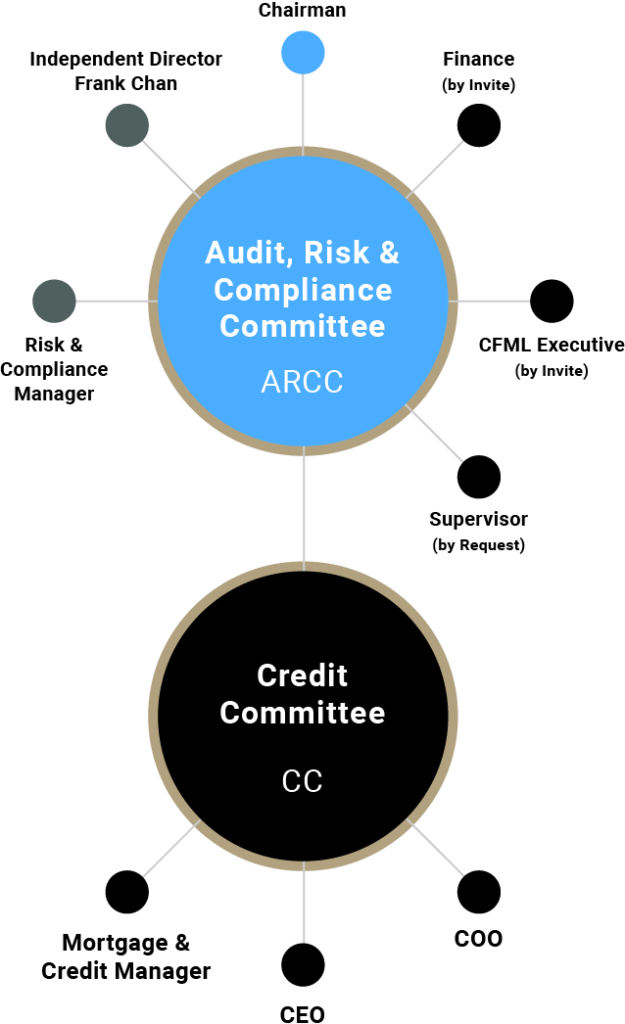

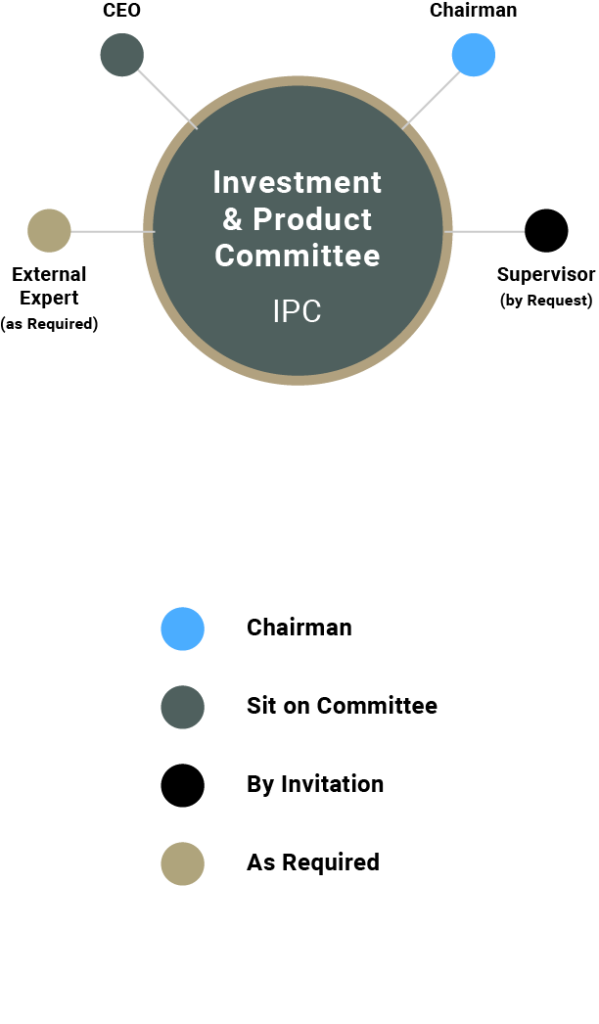

CFML has an independent Board and three committees which have specific responsibilities to manage risk.

The Audit Risk & Compliance Committee’s (ARCC) purpose is to assist the Board in fulfilling its governance, risk, compliance and audit responsibilities by overseeing and providing advice to the Board.

The Investment & Product Committee’s (IPC) purpose is, on behalf of the Board, to oversee, select, approve and monitor new investment opportunities for the company.

The Credit Committee’s (CC) purpose is to oversee, select and approve loans for the CFML Mortgage Fund.

Code of Ethics

This Code sets out the expectations for ethical decision-making and personal behaviour of all directors and employees of CFML.

- Act for the benefit of clients and place their interests before our own. Be mindful of potentially vulnerable customers and ensure they are treated appropriately.

- Act with honesty and integrity and avoid or disclose all actual or apparent conflicts of interest.

- Do not give and refuse to accept any gifts or gratuities that could reasonably be expected to affect our or the other person’s independence, objectivity, or our duties to our or their clients.

- Act in good faith and with due care, competence, diligence, respect, and in an ethical, transparent and timely manner.

- Communicate with and report to clients in a timely and accurate manner. Deal with any complaints respectfully and promptly.

- Act in CFML’s best interests in accordance with all applicable laws and regulations, policies and industry best practice.

- Keep client information confidential unless required by law. Do not use confidential information for personal advantage or any improper purpose.

- Maintain CFML’s financial accounts and records accurately and properly and ensure timely reporting and disclosure in a manner consistent with applicable laws.

- Act and encourage others to act in a professional and ethical manner that will bring credit to CFML, its directors, officers, owners and employees. Foster and build a culture where we lead by example, work as a team and where complaints, concerns or suggestions are respected and heard.

- Support and co-operate with CFML people, stakeholders and external providers to build an inclusive, diverse, collaborative, respectful and environmentally conscious working environment and culture.

Any unethical behaviour and or decision-making must be reported in accordance with CFML’s HR Policy and Whistleblowing Policy. Any breaches will be dealt with as set out in the Breach and Incident Handling Policy.

Useful Links

Links for Regulators, Authorities and other organisations CFML works with.